san antonio tax rate property

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Alternatively the city could exceed the revenue cap but doing so would trigger an.

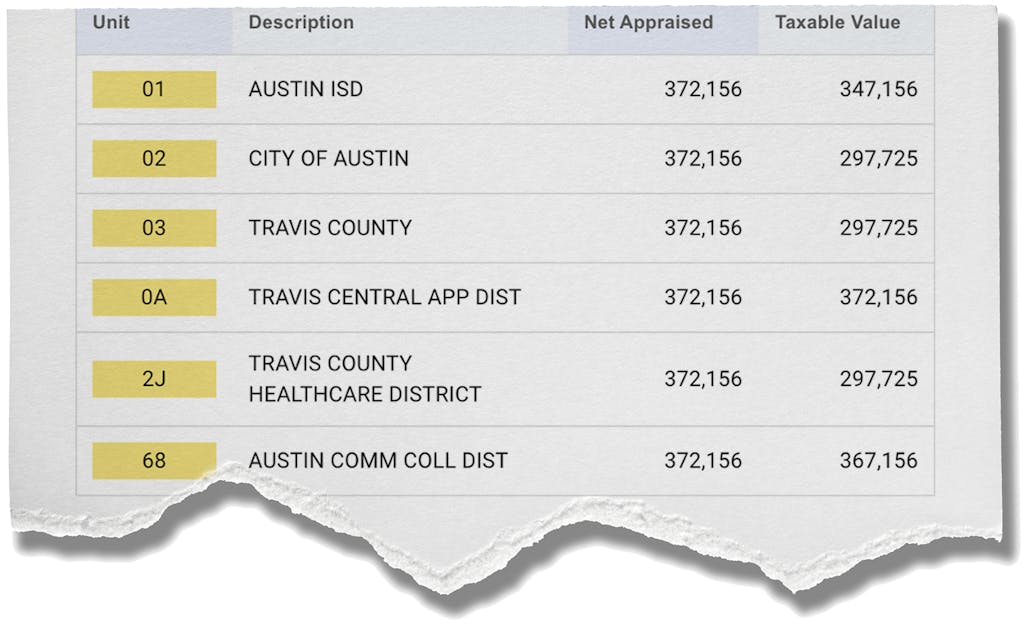

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

The tax rate varies from year to year depending on the countys needs.

. Jurors parking at the garage. Alamo Community College District. San Antonio home owners could see two changes to their 2022 property tax bills which might limit how much you have to pay.

Homestead tax exemptions 100 disabled veterans pay no property tax in the state. The citys revenues for 2022 is. City of San Antonio Attn.

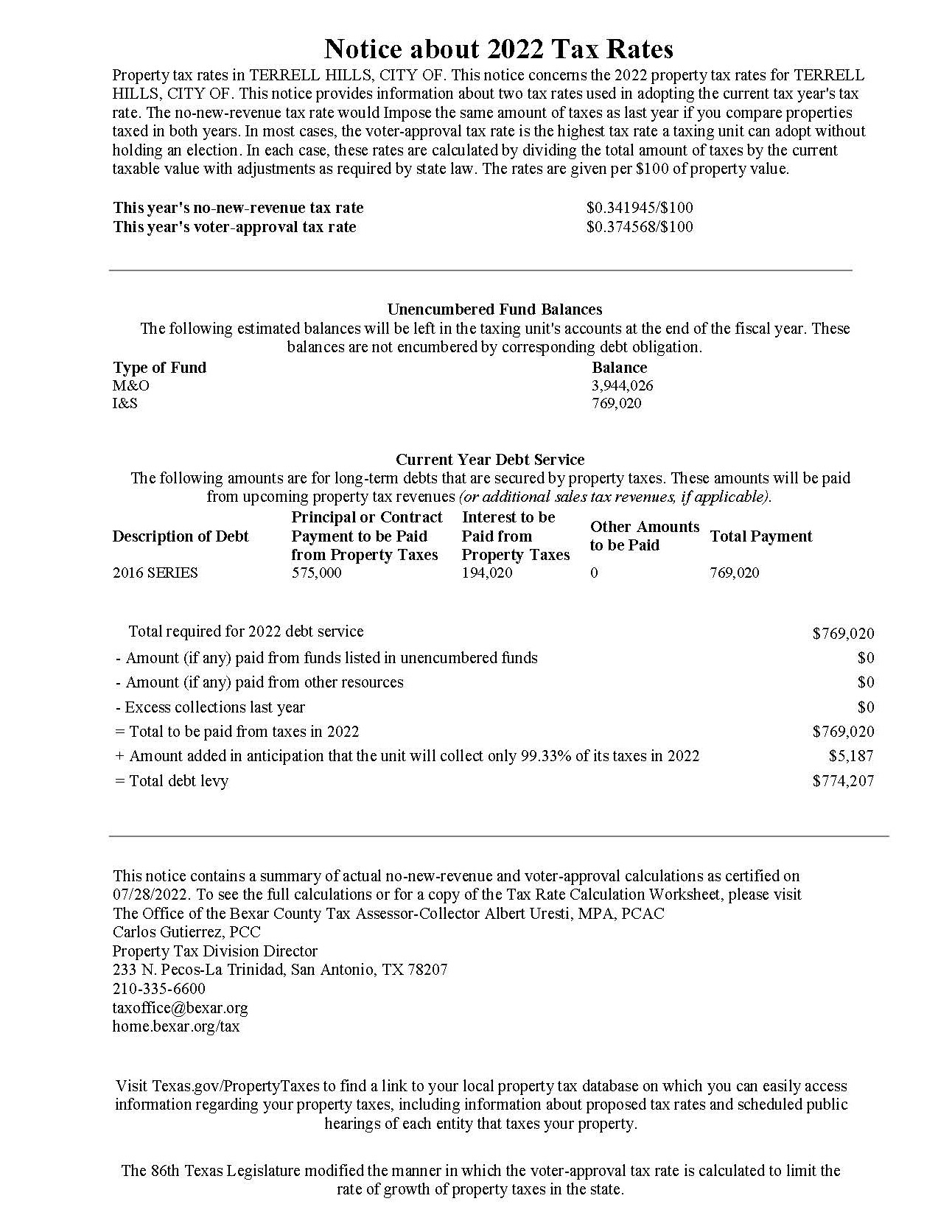

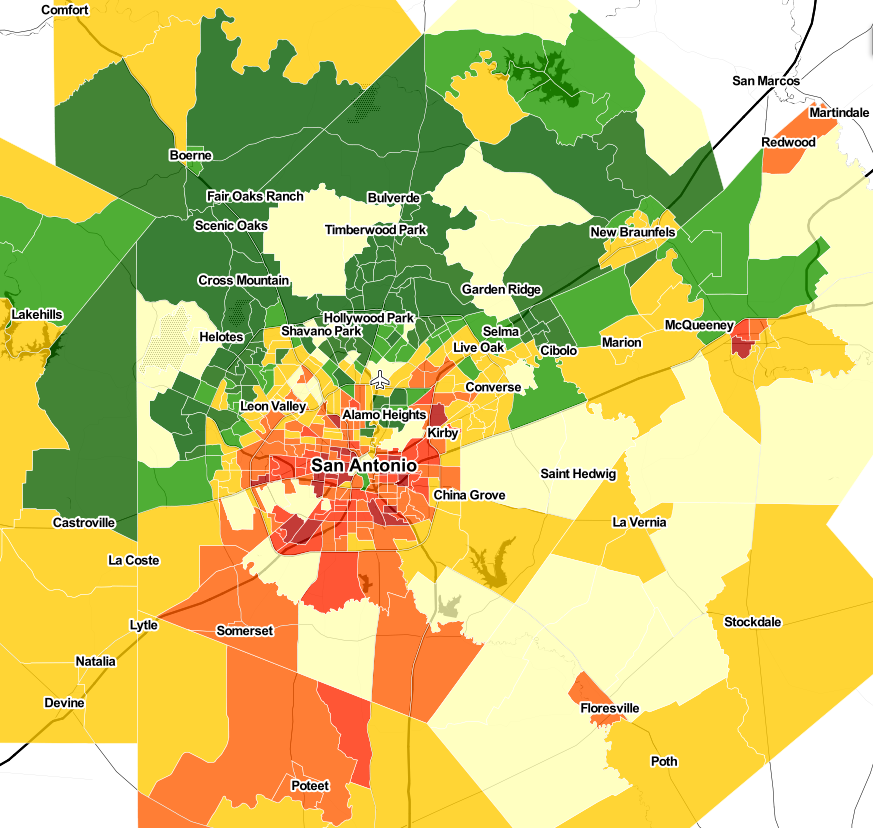

Name Code 2022 2021 2020 2019 2018. Average Property Tax Rate in San Antonio Based on latest data from the US Census Bureau San Antonio Property Taxes Range San Antonio Property Taxes Range Based on latest data from. They are calculated based on the total property value and total revenue.

For example the tax on a property appraised at 10000 will be ten times greater than a. However the median list price for a home in San Antonio is only 230000 far lower than Austin and many parts of Dallas and Houston. Rates will vary and will be posted upon arrival.

If council members kept the tax. PersonDepartment PO Box. SAN ANTONIO June 16 2022 Today the San Antonio City Council unanimously approved new property tax relief measures that will bring relief to taxpayers this fall.

San Antonio residents pay almost 57. Find the local property tax rates for San Antonio area cities towns school districts and Texas counties. 212 of home value Yearly median tax in Bexar County The median property tax in Bexar County Texas is 2484.

Tax statements are then sent to all property owners. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. Bexar County Texas Property Tax Go To Different County 248400 Avg.

The citys current tax rate which accounts for about 22 of property tax bills is nearly 056. Pursuant with the Texas Property Tax Code properties are taxed according to their fair market value. 23 new laws go into effect on Jan.

Tax Rates The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs. San Antonio property taxes represent about 20 percent of a homeowners total bill said Albert Uresti Bexar Countys tax assessor-collector. They range from the county to San Antonio.

In a 3-2 vote Bexar County commissioners voted Friday to set forward a reduced property tax rate in fiscal year 2022 that would save the average homeowner 4 a year. For 2018 officials have set the tax rate at 34677 cents per. Property Tax Rate Calculation Worksheets by Jurisdiction.

Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31. Road and Flood Control Fund. Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county.

Box is strongly encouraged for all incoming mail. San Antonio TX 78205 Mailing Address The Citys PO. That assigned value is multiplied by the established tax rate the sum of all applicable governmental taxing-authorized entities rates.

San Antonio May Cut City Property Tax Rate Next Year Because Of The Soaring Housing Market

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

San Antonio Real Estate Market Stats Trends For 2022

Appraisal Animosity Fuels Push To Increase Homestead Exemptions In San Antonio Tpr

Bexar S Effective Tax Rate Lower Than Last Year Commissioners Told

Bexar County Proposed Budget Will Maintain Property Tax Rate Kabb

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

How To Protest Your Property Appraisal In Bexar County

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

It S Not A Stretch To Say That Property Taxes Are Out Of Control A Think Tank Releases February Report That Shows San Antonio Property Tax Increases Outpace Preferred Rate Of Growth

Tac School Property Taxes By County

District 8 Councilman Applauds Fy 2023 Budget Including Reductions In City Property Tax Rate Investments In Public Safety And Housing The City Of San Antonio Official City Website

U S Cities With The Highest Property Taxes

Tax Rates And Local Exemptions Across Texas San Antonio Report

San Antonio Based Tech Company Says It Can Speed Up Homeowners Ability To Protest Property Taxes San Antonio News San Antonio San Antonio Current

Significant Changes Coming To Texas Property Tax System Texas Apartment Association